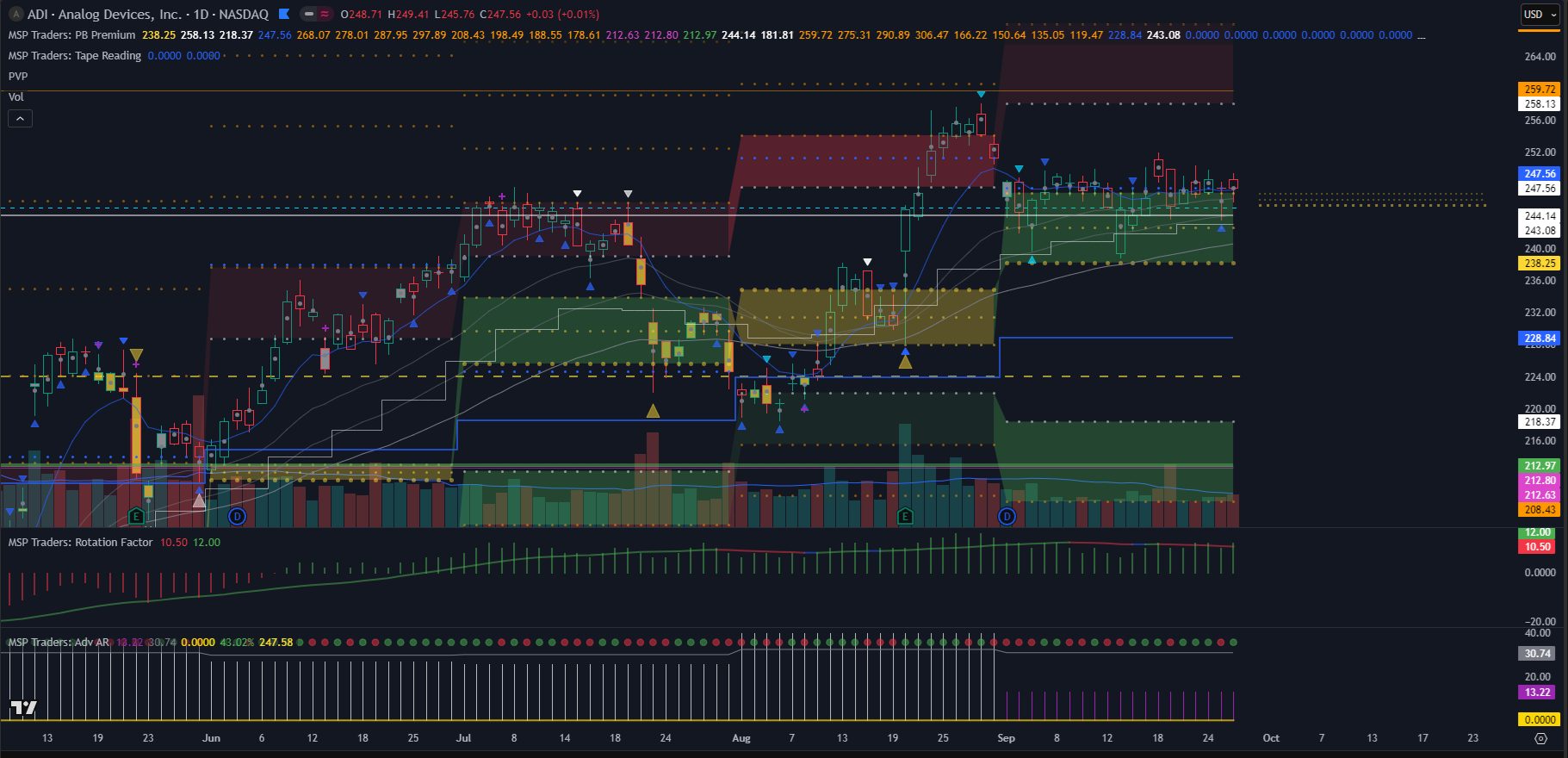

Analog Devices (NASDAQ: ADI) has been quietly building strength over the past several months, and the price action is now pointing toward a potential breakout scenario. Let’s break this down step by step.

Big Picture: Price Above Previous Year’s High

One of the strongest signals for higher timeframe momentum is when a stock trades above its previous year’s high.

For ADI, that’s exactly what’s happening right now. Price is holding above last year’s high, which tells us that outside timeframe (OTF) buyers remain in control. Institutions and long-term participants are clearly positioning on the bullish side, and as long as this condition holds, ADI remains a candidate for continued upside.

Think of it this way: when a stock lives above its prior yearly high, it’s in uncharted bullish territory where new buyers often keep stepping in.

September: A Narrow Range Consolidation

While the big picture is bullish, September has been a different story. Instead of trending higher, ADI has been consolidating in a narrow monthly range.

This type of price action is healthy—it shows that after a strong move, the market is taking a breather, allowing buyers and sellers to battle it out before the next directional leg. Narrow ranges often precede expansion moves.

Key Level to Watch: $244

Here’s where things get interesting.

- If ADI can close September above $244, it sets up October as a strong breakout month.

- A monthly close over this key level would confirm that buyers have absorbed supply and are ready to push price into new highs.

This is a classic compression → expansion setup.

What Traders Should Look For

- Monthly Close: The $244 level is the line in the sand. Bulls want to see price close above it.

- October Follow-Through: If September ends strong, the October candle could open the door for fresh momentum.

- Risk Management: Narrow ranges can also break down, so stops and position sizing remain crucial.

Final Thoughts

Analog Devices (ADI) is showing all the signs of a potential breakout setup. With price above the previous year’s high and a narrow consolidation forming, October could be the month when the bulls make their next move.

👉 Traders should keep an eye on the $244 monthly close level. If the stock finishes September above it, the breakout probability for October increases significantly.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Follow on X – https://x.com/MSP_Traders