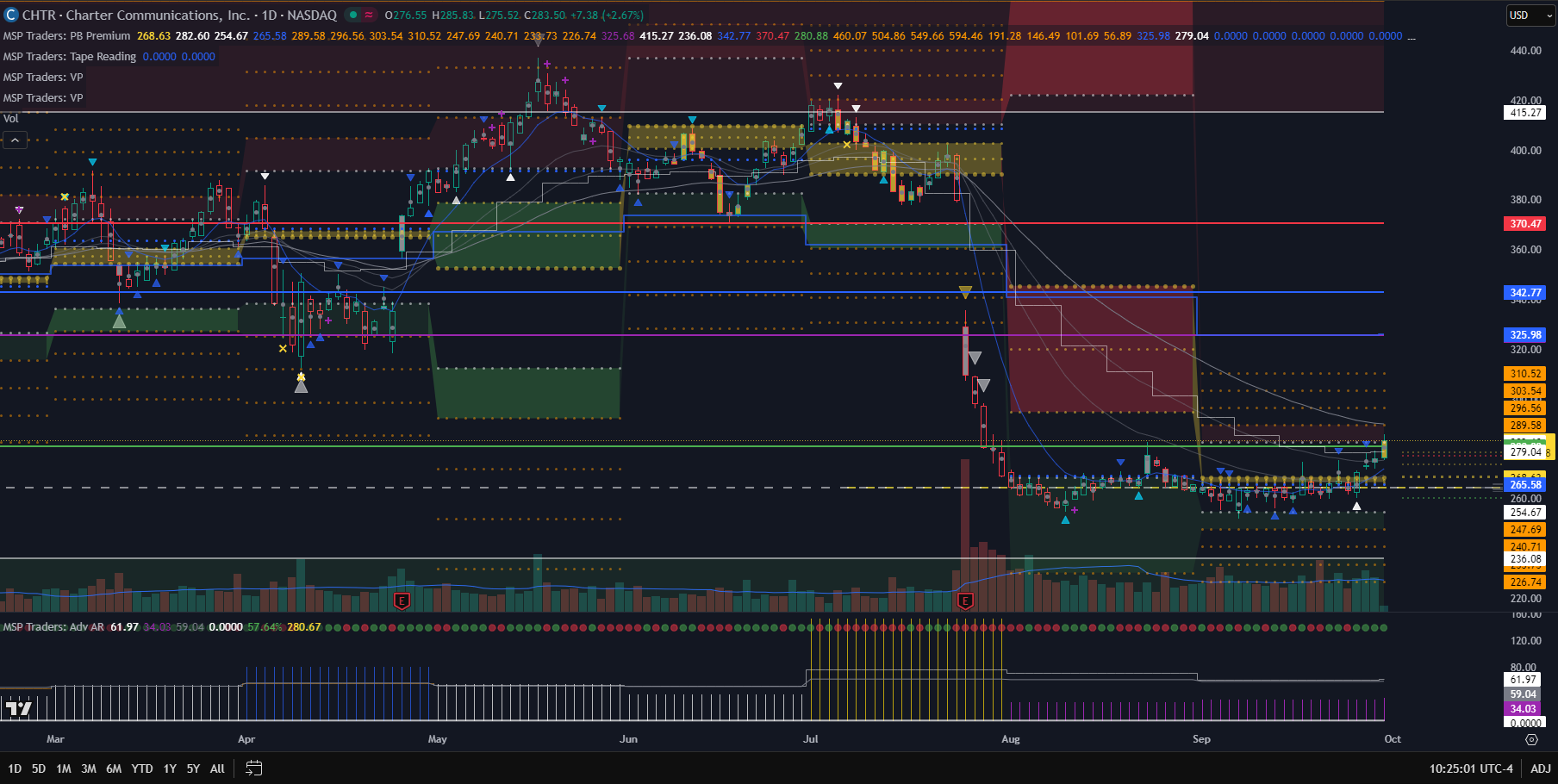

When a stock experiences a sharp decline, it often leaves traders wondering: is this a discount opportunity, or is there more downside left? Charter Communications (CHTR) is a great example of how multi-timeframe pivot analysis can help us answer that question.

July’s Sharp Drop — Discounted Price Zone

CHTR saw a huge drop in July 2025, pushing price into a discounted zone. This sharp move forced the market to quickly re-evaluate value. After such a fall, the question becomes: is the stock cheap enough for buyers to step in, or will it need to travel lower before real support emerges?

August & September — Cooling Period, Price Acceptance

Following the steep decline, August and September have acted as a cooling period. Instead of continuing the fall, price has started to move sideways. This is a classic sign of acceptance — the market is willing to transact at this level, neither rushing higher nor breaking down further.

Cooling periods are important. They tell us the market is digesting the earlier move and building a new balance zone. This prepares the stage for the next directional leg.

OTF Perspective — Still Room on the Downside

Looking at the other timeframe (OTF, yearly), we can see that while the stock dropped heavily, it hasn’t yet touched the previous year’s low. That’s an important reference point.

This tells us two things:

- The downside move may not be fully complete yet.

- The market could spend more time consolidating before either testing that low or confirming support above it.

Patience is required here, as the OTF picture suggests the bigger players are not finished repositioning.

Potential Reversal Path

If price takes support at current levels or later at the previous year’s low, a reversal becomes possible. The upside roadmap would look like this:

- Return to the yearly CPR (Central Pivot Range).

- Move toward the previous year’s close.

- Stretch higher to test the previous year’s high.

This sequence is how reversals typically unfold across OTF pivots — each step reclaiming lost ground before attempting the next.

Bearish Scenario — What If Support Breaks?

The previous year’s low is a critical line in the sand. If price fails to hold that level, we could see a massive drop again as OTF participants push the market toward fresh lower-value areas.

This is why traders must respect both possibilities:

- Support holds → gradual reversal path

- Support breaks → another wave of selling

Why HTF Analysis Matters

This entire view of CHTR is built on the principle of HTF pivot analysis. By combining OTF (yearly pivots) and STF (monthly pivots), you can:

- See where larger players are active

- Understand whether the market is trending, balancing, or reversing

- Build patience by waiting for alignment instead of reacting to noise

👉 If you’re new to this concept, I’ve explained it in detail here:

HTF Pivot Points — Beginner’s Guide

Final Thoughts

Charter’s July drop created a discount opportunity, but the bigger picture tells us the story isn’t finished. August and September have been about cooling and acceptance. The yearly pivots suggest more time is needed, and only a clear support — either now or at last year’s low — will confirm the next upside journey.

But remember: if the previous year’s low fails to hold, another sharp leg down could be waiting.

This is the essence of pivot-based multi-timeframe trading: balance patience with structure, and let the market show you where it wants to go.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Follow on X – https://x.com/MSP_Traders