Coeur Mining (CDE) has caught the attention of traders recently after a sharp fall of more than 25% in just a few trading days. In this blog, we’ll break down the stock’s performance using pivot points, analyze the recent pullback, and understand what’s happening at current price levels.

CDE’s Strong Bullish Trend Over the Last Year

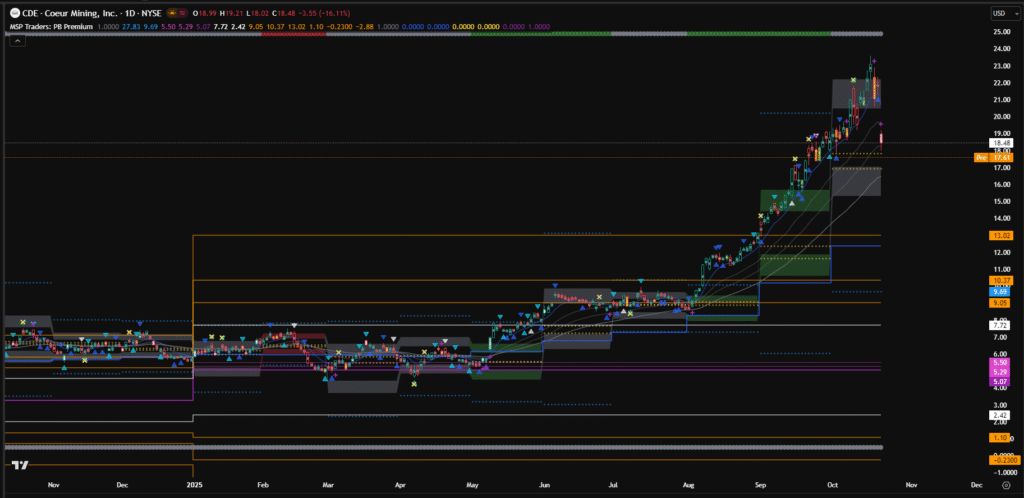

Over the past year, CDE stock has shown a remarkable bullish trend, moving over 240%. While catching the full move is difficult for any trader, you can capture a significant portion of the trend if you have the right tools and strategy.

I personally use the Central Pivot Range (CPR) as a trend detector. This tool helps identify the start of strong moves and provides clear support/resistance levels to trade with confidence. You can learn more about using CPR in trading here.

When CDE began its rally, it found strong support at the yearly CPR, gradually breaking previous year’s highs and multiple resistance levels. This is a classic example of following the footsteps of big players in the market. Understanding this concept can help traders identify high-probability setups. Read more about it here.

Note: Purple lines = Yearly CPR, White Lines = Previous Year High / Low, Orange Lines = Support and Resistance

Why CDE Stock Fell – Profit Booking Explained

The recent 25% decline is primarily due to profit booking. After such a large rally, traders and institutions naturally take profits, causing a short-term pullback.

Currently, there’s no strong sign of a trend reversal. After major moves, stocks usually enter a trading range, digesting gains before resuming the uptrend or forming a structured reversal. You can learn about this behavior in my post on Price Acceptance.

Using Pivot Points for CDE Stock Analysis

Pivot points are essential for understanding where CDE may find support or resistance during pullbacks. By plotting yearly and monthly pivot points, traders can identify key zones to watch for price action. This helps manage risk while trading pullbacks or planning entries. Learn the basics of pivot points here.

Key Pivot Levels to Watch

- Yearly Pivot: Strong support zone where price found initial bounce.

- Monthly Pivot: Intermediate support/resistance for swing trades.

Key Takeaways for Traders

- CDE’s recent decline is profit booking, not a breakdown.

- Capture moves with CPR trend detection for better entries.

- Follow the footprints of big players to understand market behavior.

- Expect a trading range before any major reversal.

- Use pivot points to plan entries, exits, and manage risk.

In summary, the recent pullback in CDE stock is part of a healthy consolidation, and the overall bullish trend remains intact. Traders should focus on key pivot levels, watch for trading range formations, and plan trades accordingly.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Social Profiles:

Follow on X

Follow on Facebook