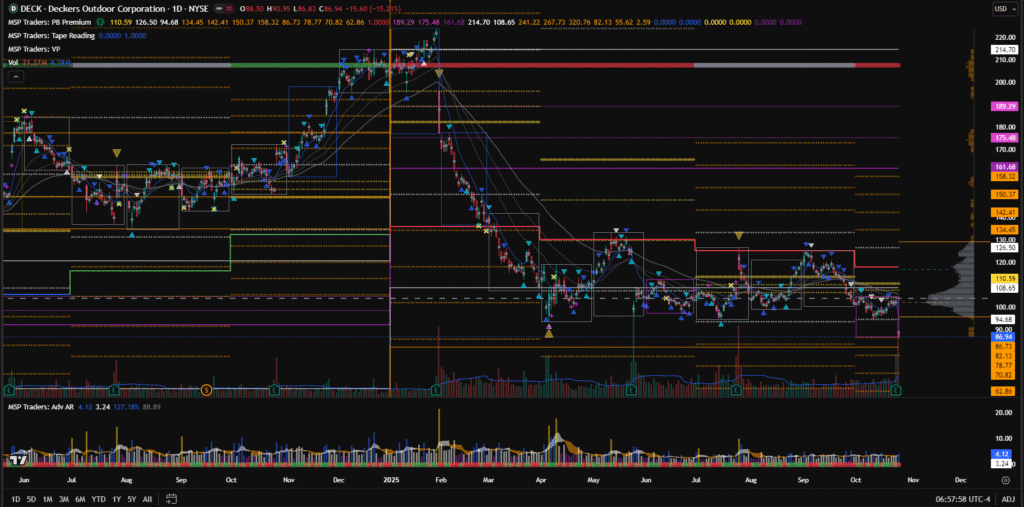

The stock of Deckers Outdoor Corporation (NYSE: DECK) witnessed a sharp decline of over 15% on Friday, marking one of its biggest single-day losses of the year. What’s even more concerning is that this fall comes after a massive 45% drop during the first three months of 2025 (January–March). This consistent downside pressure clearly indicates a strong bearish sentiment dominating the stock for quite some time. However, after such a deep fall, it’s equally important to observe where the price is now and what it’s trying to do next.

Breaking Out of a 6–7 Month Trading Range

Before Friday’s crash, DECK had been moving inside a sideways trading range for nearly six to seven months. This range acted as a consolidation phase — a zone where both buyers and sellers were battling for control. But on Friday, the stock failed to hold inside that structure and finally broke below the lower boundary of the range. Such a breakdown after months of compression often carries significant implications — it can either trigger a continuation of the downtrend or lead to a false breakout followed by a powerful reversal.

Two Possible Scenarios Ahead

1️⃣ Continuation to the Downside

If DECK truly follows through with this breakdown, the downside could be massive. The stock had been storing “energy” during its long consolidation — meaning that a clean break could lead to a large directional move as sellers gain confidence and momentum funds join the move. However, this is only valid if the stock fails to attract buying pressure around key support zones.

2️⃣ Potential Reversal From the Lows (More Likely Scenario)

Interestingly, DECK is now trading right around its previous year’s low. This level has acted as a critical support zone in the past. If the stock were truly bearish, it would likely have broken decisively below that level already. The fact that it’s holding steady near this area indicates possible absorption of selling — a signal that the downside pressure might be exhausting. If DECK starts closing above the previous session’s high, that could be the first sign of a short-term reversal. Once the gap begins to fill, the price may re-enter the old trading range, paving the way for a strong recovery.

Upside Targets If Reversal Confirms

If the reversal plays out as anticipated, the first target would be the Yearly CPR (Central Pivot Range) — a key equilibrium zone for institutional traders. The next upside objective would be the previous year’s high, marking a full recovery from the recent breakdown. These are not random levels but structural zones where institutions often react, creating predictable price behavior for swing traders.

Understanding the Bigger Picture

To truly understand how these setups evolve and why stocks behave this way around pivots and ranges, you can read these in-depth guides:

📘 Using CPR as a Powerful Trend Detector in Trading — Learn how to identify the dominant market direction.

📗 Price Acceptance: How to Identify a Trading Range Before Everyone Else — Understand how markets form ranges and why they matter.

📙 HTF Pivot Analysis — Following the Big Players — Discover how institutional traders operate and how you can align with them.

Final Thoughts

While Deckers Outdoor Corporation (DECK) appears weak on the surface after back-to-back declines, price behavior near major support zones often tells a different story. If buyers manage to reclaim control by pushing above previous session highs, we may soon witness a re-entry into the old trading range — setting the stage for a powerful upside reversal. Until then, keep your eyes on price acceptance and pivot reactions — they often reveal the true intentions of the market long before the crowd notices.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Social Profiles:

Follow on X

Follow on Facebook