Trading has been a journey of evolution for me, starting while I was a full-time working professional trying to understand the markets during limited free time. At first, I relied heavily on moving averages. They gave a sense of direction, but they didn’t allow me to plan trades precisely or set alerts at key levels. I wanted a method that would tell me where the market might react, where bulls and bears were defending, and where pullbacks could present high-probability opportunities. That’s when I discovered Pivot Points, and they immediately became the core of my trading strategy. These levels weren’t just lines—they were a lens to read the market, revealing the invisible battle between buyers and sellers.

This lesson is part of the Premium Training. You can read all of the lessons here.

Discovering the Power of Pivot Points

Pivot Points are calculated from the previous period’s high, low, and close prices. They provide reference levels for potential support and resistance and help identify market structure. I explored multiple types of pivots but found Traditional to be the most insightful. Using this me to witness the tug-of-war between bulls and bears in real time. After countless hours of backtesting and chart observation, these pivots consistently highlighted the setups with the best probability of success. Pivot Points became more than technical tools—they became a way to interpret market behavior and anticipate trend movements.

Introducing the Central Pivot Range (CPR)

Later, I discovered the Central Pivot Range (CPR), a modern variation by Franklin O. Ochoa. The CPR provides a range rather than a single level, adding nuance to traditional pivots. Observing price interaction with the CPR revealed a core principle: in a trending market, price moves with discipline. In a bearish trend, the CPR slopes downward and price typically closes below it, while rallies to the CPR present optimal shorting opportunities. Conversely, in a bullish trend, the CPR slopes upward, and price closes above it. Pullbacks to this zone become some of the most precise buying opportunities I’ve seen.

I remember Tesla’s quarterly chart vividly. For months, price continued to fall, closing below the CPR and making new lows each quarter. By the end of June, the pattern shifted: price failed to make a new low, closed above the CPR, and opened above it in the following period. That pullback into the CPR created a perfect buying opportunity, leading to a strong upward move. This experience reinforced one of the most important lessons in trading: follow the trend and respect the zones where the market is defending its territory.

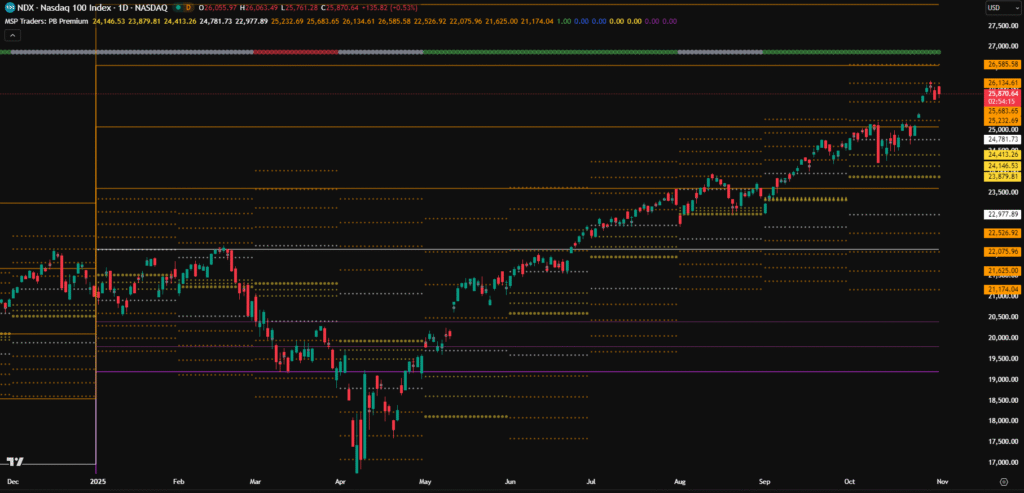

Example: Identifying a Strong Trend Using CPR (Nasdaq Index)

Let’s take an example from the Nasdaq Index. You can see the price moving strongly to the upside. Many traders will show you a chart like this and say, “This is a perfect example of CPR in action.” But in real market conditions, the movement is not always this clean. To truly understand such strong trends, you need to focus on the context — specifically, what the big players are doing behind the scenes.

Now, look at the bigger picture. The price had dropped during February and March, and then took support in April. I’m not here to act like a fancy guru and tell you to enter exactly at that point just because the market later moved higher. Instead, let’s understand why waiting for confirmation is essential. The area where price took support aligns with the Yearly CPR (purple line), which means the long-term trend found a base at a major higher timeframe pivot. From there, the market began its upside journey, breaking the previous year’s high (white line), and then moving further above R1, R2, and beyond.

Now, here’s the key point. The support we just discussed becomes confirmed in May, when the monthly candle opens above the Monthly CPR (yellow line) and continues to open and close above it for the next few months. As long as this pattern of monthly candles consistently opening and closing above the Monthly CPR continues, the market remains in a strong uptrend. This structure is what helps you identify and ride powerful trends with confidence rather than chasing every move blindly.

I’ve explained this concept in detail here: 👉 Higher Timeframe Pivot Analysis: Following the Big Players

Another example can be seen on Airbnb. If you look at the chart, you’ll notice that the price is not consistently following the opening and closing rule. This inconsistency is the reason the chart looks so random and lacks the clear upward movement seen in the Nasdaq Index. In a trending market, each monthly opening and closing should occur on the same side of the Monthly CPR — either both above it in an uptrend or both below it in a downtrend.

When this alignment is missing, it usually indicates a trading range market, where price keeps oscillating between support and resistance without clear directional strength. Such markets require a completely different trading approach, which we’ll discuss separately. In this lesson, our focus remains only on identifying and understanding trending market behavior.

Recognizing Trend Shifts in Markets

As you’ve seen in both the Nasdaq and Airbnb examples, CPR alone doesn’t create trends — it helps you interpret them when combined with context and confirmation. A strong trend is not about price just moving in one direction; it’s about consistency in structure — when each new candle opens and closes on the same side of the CPR, showing clear dominance from one side of the market.

Once you start observing these opening–closing relationships across higher timeframes, you’ll begin to understand how professionals identify strong trends early and stay with them confidently. Always remember, your goal is not to catch the bottom or top, but to recognize when a confirmed trend is in motion — and then simply follow it with discipline.