When I started trading, I relied heavily on moving averages. They were my primary guide for entries and exits. But they had a limitation—moving averages lag. I needed something that could project future key levels, especially since I couldn’t watch the charts all day due to my full-time job.

That’s when I discovered pivot points—levels calculated from the prior period’s data to project the next period’s potential turning points. They gave me predefined zones where the market might react.

At first, I calculated them manually in Excel—a tedious job. But the game changed when I found TradingView. Its Pine Script feature let me code my own pivot point indicator—dynamic levels that adjust automatically with market movement. Whether the price moved higher, dropped, or went sideways, my pivots updated accordingly.

From Standard Pivots to Camarilla

In the early days, I used standard pivot points to catch breakouts. But soon I realised that failed breakouts offered equally good (if not better) opportunities.

That’s when I started exploring Camarilla pivots, which are tighter and more suitable for identifying failure setups. The H3 and H4 levels became my favourite zones—they often reveal when a breakout attempt is losing steam.

Breakout and Failed Breakout Focus

Over time, my trading narrowed down to just two high-probability setups:

- True breakouts above key pivot levels with volume confirmation.

- Failed breakouts where the market pierces a pivot level but fails to sustain.

For example, if the price goes above previous day high (PDH) or Camarilla H4, but fails to hold and closes back below, that’s my cue to prepare for a short.

Why short? Because traders who went long expecting continuation will start exiting when their stops get hit. That selling pressure often attracts new sellers, creating a cascade move. Combine that with a good candlestick rejection pattern and volume confirmation, and I have a setup with risk-to-reward of at least 1:5.

My Favourite Confirmation – Candlestick Strength

While many traders use formal patterns like the engulfing candle, I take it a step further.

I prefer an engulf of the full range (high to low), not just the candle body. This shows even more strength or weakness at the key level.

A big wick rejection or full-range engulfing near my pivot zone tells me the market is making a decisive move.

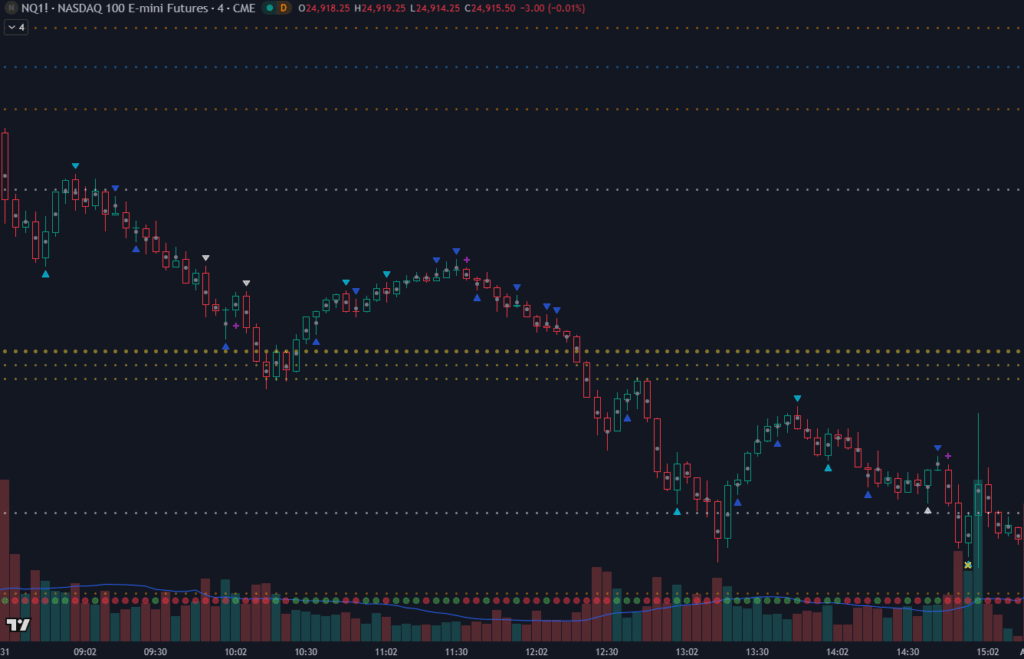

Case Study – NQ Futures, July 31

One of the clearest examples of my pivot point approach came on July 31st, trading NQ Futures.

- Market Open: Above PDH (Previous Day High), classic breakout territory.

- First 2-Min Candle: Closed below PDH on above-average volume → first sign of weakness.

- 8:56 AM: Price made a green candle closing above PDH, but volume was low → buyers not interested.

- Entry: Short on a bearish engulfing candle rejecting PDH.

What followed? The price fell all day, as early buyers booked profits, breakout buyers were trapped, and selling pressure built.

Mistakes I Made Early On

In my early trading, I treated pivot levels like lines carved in stone—thinking price must bounce or reverse there.

Now I see them as two-way decision zones.

- If the level holds, the trend continues.

- If it fails, it often sparks the opposite move.

The failed breakout scenario works best after 3–5 days of strong bullish trend, when the market is overextended, and profit booking is likely.

The breakthrough was realizing: It’s not the line, it’s the psychology. Pivots are simply magnets for trader behavior—where traps are set, stops get hit, and momentum shifts.

Why Pivot Points Work for Me

- Predefined levels to plan ahead without watching charts all day.

- Fits perfectly with my breakout/failed breakout strategy.

- Combines naturally with candlestick strength and volume confirmation.

- Works across markets—futures, stocks, forex.

Conclusion

Trading pivot points isn’t about blindly buying support or selling resistance. It’s about reading the battle between buyers and sellers at those levels. Combine them with volume and strong price action, and they can become one of the most reliable tools in your trading arsenal.