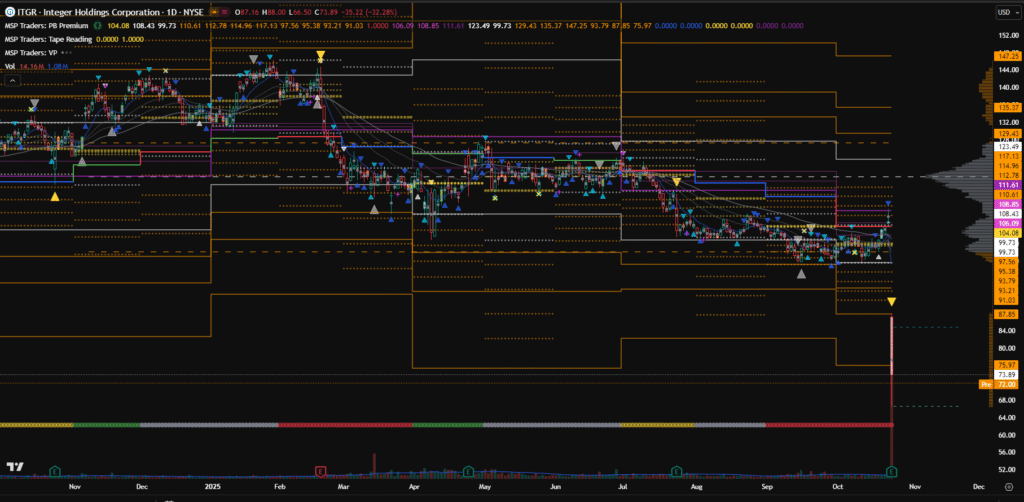

Integer Holdings Corporation (ITGR) witnessed a massive crash of over 32% in a single session — a move that shook long-term investors and traders alike. What’s even more striking is the trading volume, which surged to 14 times higher than its normal average volume.

Let’s break down what’s happening at the current level using pivot-based analysis and the principles of market structure.

🔍 The Big Picture: From Steady Decline to a Major Breakdown

This isn’t the first time ITGR has shown weakness.

The stock had already been falling steadily for the past few months, down about 25% from its all-time high even before Thursday’s collapse.

Thursday’s gap-down opening added to the pain, and now ITGR is trading nearly 50% below its all-time high.

But remember — just because a stock is down 50% doesn’t automatically make it “cheap” or “discounted.”

In market structure terms, a falling stock is usually part of a mark-down phase, not a “sale.” Prices move lower for a reason — because big players are exiting long positions or entering fresh short positions.

🧭 Using Pivot Analysis to Read Market Structure

I use Pivot Points — specifically the Central Pivot Range (CPR) — to decode market behavior step by step.

We can’t predict when or how much a stock will fall, but we can interpret the context in which it’s happening.

In ITGR’s case, the stock has been continuously opening below the CPR for several months.

This is a textbook bearish opening, signaling sustained selling pressure.

If you’re not familiar with how CPR reveals the underlying trend, I’ve explained the concept here:

👉 Using CPR as a Powerful Trend Detector in Trading

This rule-based reading of opening and closing relative to CPR is one of the simplest and most effective ways to identify whether a stock is in a bullish or bearish phase — without guessing or predicting.

📊 Volume Spike & Institutional Activity — What the Big Players Are Doing

The 14x volume spike on the crash day tells a bigger story.

Such high volume isn’t retail panic — it’s institutional activity. When large players unload their positions, they leave behind footprints in the form of abnormal volume and wide-range bars.

Currently, ITGR is trading below the previous quarter’s low, confirming a breakdown beyond major structure levels.

This kind of move usually triggers long-term portfolio rebalancing, not quick rebounds.

So, don’t expect the price to simply bounce back and “fill the gap.”

For that to happen, the stock will need to:

- Form a trading range (a phase of price acceptance)

- Absorb the selling pressure

- Show sustained sideways consolidation

Only then can a mark-up phase begin.

Right now, ITGR is in the mark-down phase, and it may take several months before we see signs of accumulation or trend reversal.

To understand how big players create trading ranges and how price acceptance forms, you can refer to these detailed guides:

👉 HTF Analysis: Following the Big Players

👉 Price Acceptance — The Hidden Key Behind Every Reversal

⚠️ What to Expect Next

At this stage, the most probable scenarios are:

- Continued downside or sideways consolidation within a defined range

- No sustainable uptrend until the stock shows acceptance at a lower level

- Volume reduction over the next few weeks, followed by potential base-building

As a trader, patience is key. Watch how the stock behaves around the next quarterly pivot levels.

A strong close above monthly CPR after consolidation would be the first early sign of strength — but we’re not there yet.

🧩 Final Thoughts

The 32% crash in Integer Holdings Corporation (ITGR) wasn’t random — it was the result of a long-term bearish structure unfolding over several months.

With multiple closes below CPR, heavy volume distribution, and a breakdown below key pivot levels, the stock remains in bear territory for now.

For traders who follow systematic, pivot-based methods, this is a perfect case study to understand how trend direction, volume activity, and institutional behavior align before such a sharp move.

📘 Related Reads

- Using CPR as a Powerful Trend Detector in Trading

- Higher Timeframe Pivot Analysis: Following the Big Players

- Price Acceptance — The Hidden Key Behind Every Reversal

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Social Profiles:

Follow on X

Follow on Facebook