MercadoLibre Inc (MELI) has dropped sharply since its September high, and many traders think the larger trend has reversed. But when we step back, the stock has been bullish since mid-2022. No market trends in a straight line. Every trend cycles through three behaviours: a mark-up, a pause, and then either continuation or a markdown.

In this case study, we focus entirely on the pause phase, which I call Price Acceptance.

Why Price Acceptance Matters

The key to consistent swing trading is identifying which phase the stock is currently in. During the pause or acceptance phase, price stops trending and begins moving inside a range. This creates predictable behavior that repeat traders can lean on. MELI is a perfect example.

What the Chart Shows

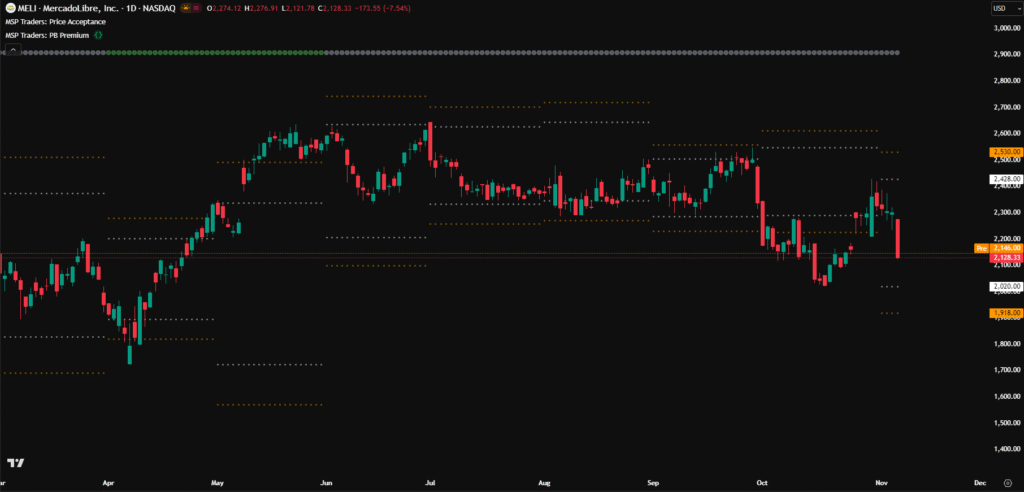

If you look at MELI’s chart, the stock has been stuck in a sideways range since June. It repeatedly struggled to break above key levels, and eventually got rejected at the previous month’s high in September.

This rejection wasn’t random. It was a classic sign of Price Acceptance. When price is accepted inside a range for a long time, it often reacts strongly when testing old highs or lows.

Mechanical Confirmation

My approach is fully mechanical. On the chart, the grey circles after the green ones mark the start of the acceptance phase. This tells me the bullish leg has paused, and price is now rotating inside a defined zone. That zone in MELI is roughly a 10 percent trading range, which is ideal for swing traders.

How the Trade Setup Formed

The trade plan during Price Acceptance is straightforward. Watch for rejections at:

- Previous month’s high or low

- Major swing highs or lows

- Strong response zones

In MELI, the trigger came exactly from the previous month’s high. When a stock has been trapped in a range for months, these levels become magnets and rejection points.

Why This Concept Is a Swing Trader’s Sweet Spot

Price Acceptance helps traders:

- Identify a sideways market early

- Avoid getting chopped in random noise

- Position for high probability swing trades

- Spot breakouts when price finally moves outside the range

Whether the range is 10 percent like MELI or sometimes much larger, this concept consistently reveals structure in what looks like chaos.

Learn the Concept and See More Case Studies

If this case study helped you understand the logic behind MELI’s recent move, you can explore the full Price Acceptance concept and Strategy here. And you can study more real-market examples here.

💬 Comment below if you’d like me to share future updates on this.

📲 Follow me on social media for regular trading insights, price behavior breakdowns, and chart updates.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Social Profiles:

Follow on X

Follow on Facebook