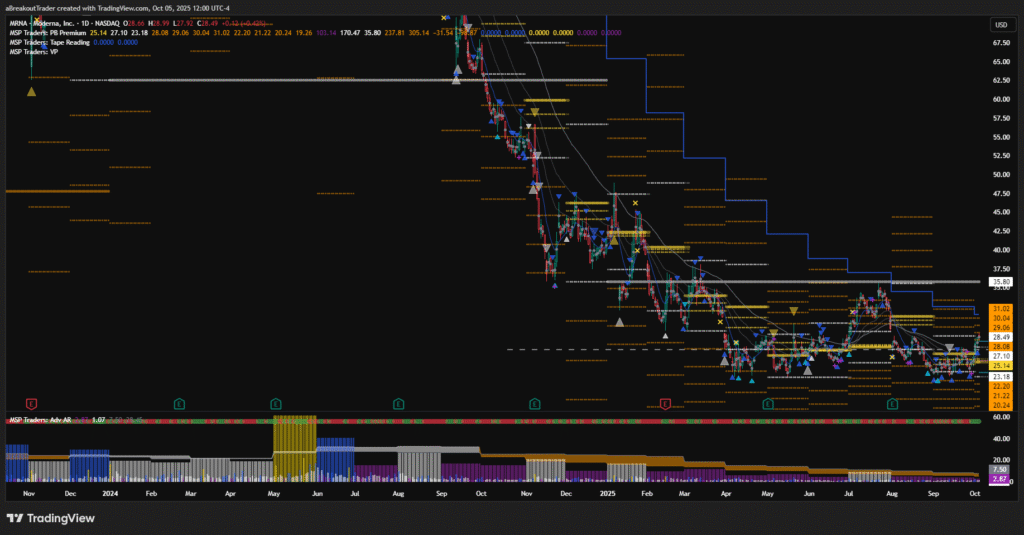

Moderna (NASDAQ: MRNA), once the pandemic-era star that skyrocketed to fame during the COVID vaccine boom, has been on a long and painful downtrend. But now, the stock is reaching a very interesting price zone — one that could define the next big move for months (or even years) to come.

1. Price Has Dropped Significantly — And It’s Now Below the Previous Year’s Low

After a long series of lower highs and weak rebounds, Moderna’s price has finally slipped below last year’s low — a level many investors considered strong support. This type of breakdown often signals fear, panic selling, and capitulation.

However, experienced traders know that below strong support is often where smart money starts quietly building positions.

2. The Current Zone Shows Signs of Acceptance

What’s fascinating right now is that MRNA isn’t free-falling anymore.

Instead, the price is getting accepted around this lower zone — meaning buyers and sellers are both active here, creating a balanced structure.

This balance has been holding for several months, hinting that the market may be preparing for a bigger move. The more time price spends here without new lows, the stronger this zone becomes as a potential base of accumulation.

3. The Bullish Scenario — 270% Upside Potential

If the price manages to reclaim the previous year’s low and sustain above it (showing clear acceptance back into the higher range), that could trigger a major reversal.

The next logical destination from a structural point of view sits around $103 — a level that aligns with historical resistance and volume buildup zones.

From current prices, that’s roughly a +270% potential move — a staggering upside if the base confirms and momentum returns to the biotech sector.

4. The Bearish Scenario — More Pain If It Fails to Reclaim

But there’s always a flip side.

If MRNA fails to sustain above the previous year’s low and sellers keep defending that level, the stock could face further decline. In that case, we could see a fresh wave of long-term liquidation before a true bottom forms.

For now, this zone remains a make-or-break level — the kind that defines whether a stock’s narrative shifts from “fallen hero” to “comeback story,” or continues as a “value trap.”

Final Thoughts

Moderna is sitting at a crucial inflection point.

This isn’t the place for emotional trades — it’s where patience, confirmation, and structure-based decision-making matter the most.

Watch how price behaves around the previous year’s low — acceptance above could mark the beginning of a massive comeback, while rejection could open the door for deeper correction.

💡 Key Takeaway:

“When price breaks below major support but starts building acceptance instead of collapsing — that’s where real opportunity often hides.”

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Follow on X – https://x.com/MSP_Traders