Most traders begin their analysis only when a new period starts. That can be a new session, a new week, a new month, or any timeframe they like to trade. They wait for the candle to close and the pivots to generate, and then they decide what to do.

But the market doesn’t wait.

Structure doesn’t wait.

Prices are constantly changing, creating hints in real time.

This is where the concept of next-period pivot projection (nPiv) becomes incredibly powerful. It lets you read the next timeframe projection before it arrives. And once you learn how the structure evolves during the current period, you start seeing the next period’s landscape take shape right in front of you.

Let’s simply walk through this entire idea. I am taking some examples of swing trading using monthly pivots.

This lesson is part of the Premium Training. You can read all of the lessons here.

The CPR That Keeps Changing

Every month begins with uncertainty. We don’t know what the pivot will look like in the end because the current month’s high, low, and close are constantly shifting. Consider CPR as an ongoing sculpture. Every new candle in the current month adds or removes something. A sudden rally pushes the developing CPR higher; a deep pullback pulls it lower; sideways movement squeezes it into a tighter range.

If you track this evolving structure, you start to understand the market’s intention even before the month ends.

Is the market trying to balance?

Is it stretching for expansion?

Is it staying compressed and preparing for a breakout?

These clues appear naturally as the developing CPR adjusts every day.

Seeing Into the Next Month

At some point during the current month, the picture becomes clear enough to give a provisional map of the next month’s pivot zone. That’s what we call the nPiv — the next-period pivot.

This is not a prediction; it’s a projection.

A story the market is trying to tell us through the shape of the current month.

When you learn to read this developing structure, you begin to notice patterns:

A month forming near its high often projects a stronger next-period pivot.

A month closing toward its lower end tends to build a softer, more downward-leaning next-period pivot.

A month stuck in a tight range creates a narrow band for the next period — the type that often precedes a strong breakout.

The key idea is this:

You don’t have to wait for the month to end to understand what might come next.

And now, let’s convert this understanding into real market stories.

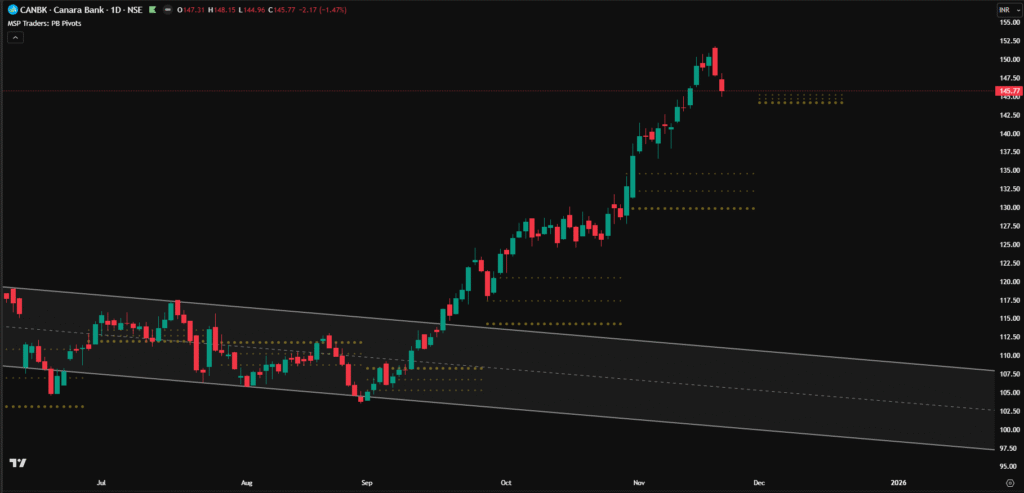

Example: Canara Bank

Let’s look at the chart below. You can see that Canara Bank has created a stunning channel breakout to the top. Compared to earlier months, CPR has increased in October and November. CPR develops a bullish bias when it maintains a consistently higher position. As you can see, the price is still rising, and December’s developing nPiv (CPR) is also higher. If November closed like this with a higher CPR for December, it would continue with its bullish bias. We can assume that the upcoming month is a bullish one. The beginning and end of each month, which I have covered here, determine this type of trending behaviour.

Example: Intel Corporation

Another example is from Intel (INTC), which made a beautiful breakout from a box range. This stock had a great month in October. As of November, we can see that the price is somehow declining. We don’t need to follow every news or event to trade. When we see that the price is falling and that the upcoming month, i.e., December CPR, is lower than the current month’s CPR, we can conclude that something is wrong. Well, it is November 22nd, and I am writing this. As a result, there has been some room for prices to rise and close there. As a result, CPR will be completely developed based on that conclusion. For example, we can assume that when the price moves up or down, the developing CPR (nPiv) can adjust to reflect the real-time market structure.

Watching Structure Instead of Guessing

Once you start seeing CPR as something that grows and evolves throughout the month, you stop guessing. You follow the structure. You track how the developing shape behaves. You notice when the market expands, contracts, or flips direction toward the end of the month.

And by the time the new month arrives, you are not starting blind. You already know the general area where the next month’s pivot will land because you witnessed its formation in real time.

This approach works for all traders, regardless of timeframe. You can apply the same thinking to weekly pivots, daily pivots, or even larger periods. The core idea remains the same:

The current period tells the story of the next.

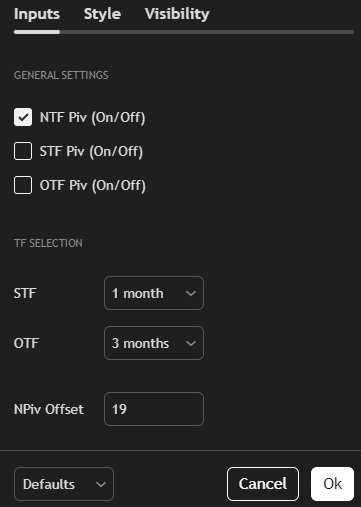

The Configuration

I’ve created a TradingView Indicator for this; simply add it to your chart. Activate the upcoming pivot timeframe by ticking the NTF Piv (On/Off) box and selecting STF (Smaller Timeframe) as 1 month or whatever timeframe you can project the next pivot to. Sometimes the candle count changes; for example, a month’s daily candle consists of 20 bars, sometimes 19, and a yearly pivot chart has 52 weekly candles or 12 monthly candles, so I’ve left this open for the user’s convenience, and you can fill in whatever you want. NPiv Offset is located at the bottom and allows you to set bars. If you encounter any difficulties, please leave a comment and I will assist you. Click here to learn more about the indicator and all of the Pivots I use.