When I first started trading, I was just like most beginners—following whatever free content was available on YouTube. I learnt the classic 20, 50, 200 SMA combination, because every channel said these were “standard”. But over time, I realised something important: standard tools create standard results, and standard results rarely grow a trader.

This lesson is part of the Premium Training. You can read all of the lessons here.

This post is about the evolution of my understanding—from basic SMAs to a premium, mentor-driven PEMA structure that completely transformed how I read trends, pullbacks, and momentum.

My Early System: The Limitations of Traditional SMAs

Back then, my setup consisted of three simple moving averages:

- 20 SMA

- 50 SMA

- 200 SMA

These are not wrong. They work well for long-term investors. But for a swing trader like me who thrives on speed, momentum, and directional bursts, SMAs felt slow and unresponsive.

Why?

Because SMA gives equal weight to every candle. A price from 20 days ago affects the line just as much as a candle from today. In fast-moving markets, that’s a major disadvantage.

And honestly, I didn’t even realise how much I was missing until I met my mentor.

The Turning Point With Franklin O. Ochoa

Under the guidance of Franklin Ochoa, my entire understanding of trend strength changed. He taught me one powerful truth:

“By the time the price touches slow-moving averages, the strong part of the trend is already over.”

This hit me hard.

I had been waiting for SMA 50 or SMA 200 pullbacks, thinking they were “safe entries”, without realising I was entering after the momentum had already cooled.

If you’re a swing trader, you don’t want to be late. You want to capture the fast part of the move, not the leftovers. That’s when I transitioned to faster, more responsive moving averages—EMAs. And eventually, to the master-level concept of PEMA.

Why EMA Itself Is Better Than SMA

Before we dive into PEMA, it’s important to understand the foundation.

EMA (Exponential Moving Average) gives more weight to recent prices, making it:

- more sensitive

- more responsive

- more momentum-friendly

This alone makes EMAs far superior for swing trading. But EMAs become even more powerful when configured correctly—and that’s where PEMA comes in.

What Exactly Is PEMA (Pivot-Based EMA)?

PEMA is the four-line EMA system I learnt from my mentor. It includes:

- 8 EMA – Ultra Fast PEMA (Blue)

- 21 EMA – Fast PEMA (Grey)

- 34 EMA – Medium PEMA (Grey)

- 55 EMA – Slow PEMA (Grey)

Each line serves a very specific purpose:

- 8 EMA tracks micro pullbacks

- 21 EMA tracks healthy trend pullbacks

- 34 EMA catches medium-volatility corrections

- 55 EMA acts as the warning zone

When the price begins touching the 55 EMA repeatedly, the trend isn’t ending—but it’s losing momentum. This multi-layer approach gives a much clearer, more structured view of momentum than any SMA ever could.

Why PEMA Is Perfect for Swing Traders

Swing trading requires:

- accurate timing

- clean pullbacks

- early entry into continuation moves

- momentum awareness

PEMA provides all of that on a single chart.

It tells you instantly whether:

- The trend is strong.

- The pullback is healthy.

- The momentum is weakening.

- It’s time to prepare for deeper corrections.

The system isn’t designed for long-term investing (there are other tools for that), but for faster swing opportunities, PEMA is unmatched.

How Strong Markets Respect PEMA

If you observe any strong bullish or bearish trend, you’ll notice a predictable pattern:

- Price bounces instantly from the 8 EMA during explosive momentum

- Pullbacks to 21 EMA are ideal continuation entries

- 34 EMA holds through medium corrections

- 55 EMA is touched when the trend is cooling

This is why PEMA works beautifully. It visually groups trend strength into layers. Instead of guessing where the pullback might bounce, the EMAs show you where the market is expected to respond.

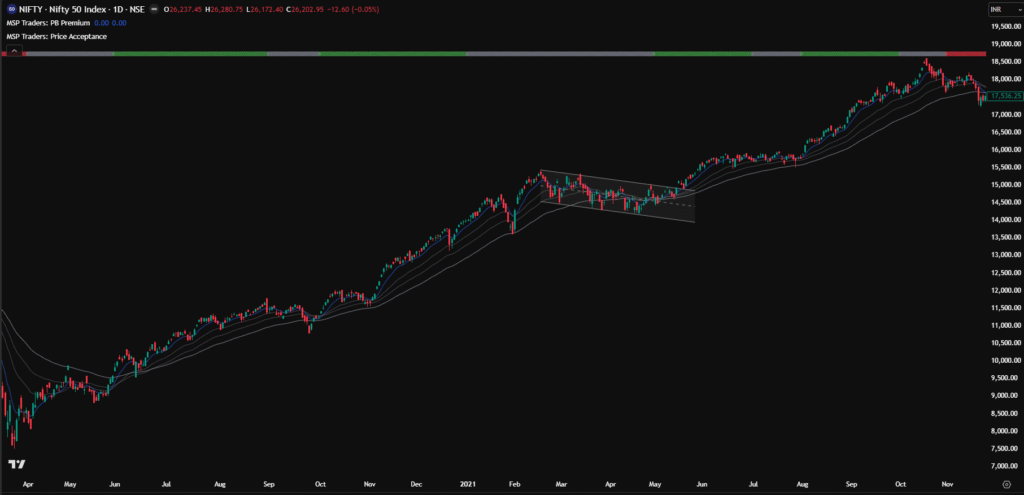

Nifty’s Post-2020 Rally: A Perfect PEMA Case Study

Let’s talk about Nifty.

After the COVID crash, the index rallied nearly 95%. The majority of traders believed the move was “already over”. But the market doesn’t work like that. Even after massive rallies, strong trends create fresh rounds of opportunity.

March, April, May: The Acceptance Phase

During these months:

- Price entered a consolidation

- A downward channel formed

- EMAs tightened

- Institutions accumulated

- Retail traders panicked

PEMA kept showing that the trend wasn’t broken:

- 21 EMA held

- No strong close below 55 EMA

- The structure suggested strength underneath

This phase is where most traders exit. But structured traders wait.

June: The Channel Breakout

Once the channel broke:

- 8 EMA crossed aggressively

- Price stayed above fast PEMA

- Every pullback became a buying opportunity

This second leg created another round of massive upside. PEMA made all of this obvious.

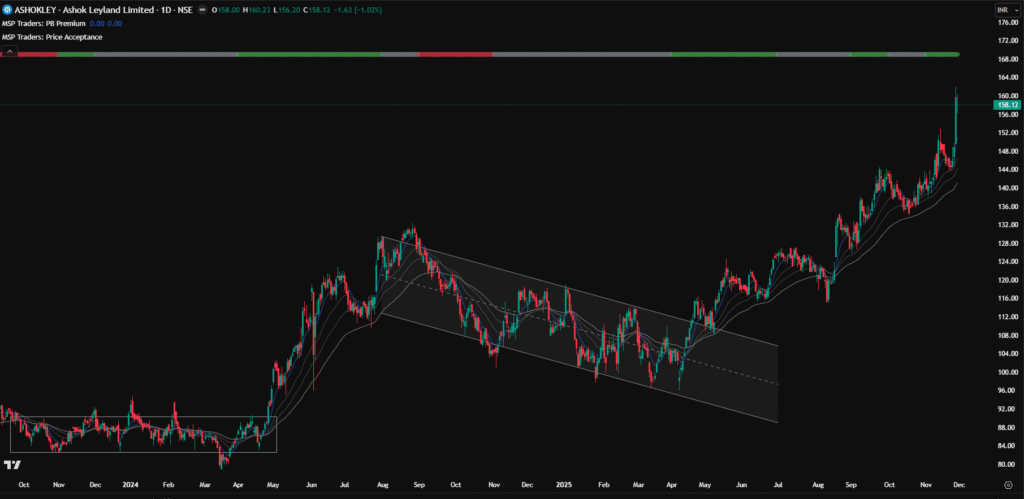

Ashok Leyland: Case Study

Let’s take a look at another chart which I have traded recently, the Ashoke Leyland. This stock has multiple bullish phases, just like the Nifty example. But remember, when we see price acceptance, this is basically a trading range behaviour. So this can appear in multiple forms, like narrow ranges, channels, triangle patterns and many more. You just need to imagine them and mark them on your chart.

In this example, the stock was inside a narrow trading range from September 2024 to April 2025, followed by a range breakout. When you see the grey colour in my indicator, you can recognise this type of range. When it breaks outside, PEMA is a good entry point to trade them.

After giving a 50%+ upside move again, it fell inside a downward channel. Finally, that channel broke in June 2025, and till now the stock has been in an upside rally. Here, every pullback inside the PEMA is a good buying opportunity.

Check out more case studies and detailed breakdowns to understand how the PEMA Method approach works in different markets and setups.

My Mechanical Approach to Identifying Ranges & Acceptance

I don’t eyeball ranges or guess channels. I use a mechanical system—a repeatable model—to identify:

- price acceptance

- trading ranges

- consolidation zones

- continuation potential

To help traders understand this deeper, I’ve written a full article on price acceptance, including a free indicator that automatically marks these acceptance zones.

You can read it here: 👉 https://msptraders.in/price-acceptance/

This indicator will help you identify the same type of consolidation phases Nifty created before the June breakout.

Final Takeaway: PEMA Is Trader’s Secret Weapon

PEMA isn’t just a set of moving averages. It’s a complete structure for understanding:

- How trends form

- How pullbacks behave

- Where momentum weakens

- Where opportunity increases

Most traders look at trends emotionally. PEMA allows you to look at them mechanically, logically, and consistently. If you want to catch strong, fast-moving swing trades, PEMA should absolutely be in your toolkit.