Before we start, let me give credit where it’s due.

The core idea of the pivots I use is inspired by Franklin O. Ochoa, also known as PivotBoss, the author of Secrets of a Pivot Boss. His framework introduced me to the structured way of using pivots — but what I’ll explain here is how I’ve refined and applied it in my own approach.

This lesson is part of the Premium Training. You can read all of the lessons here.

Understanding the Foundation: The Central Pivot Range (CPR)

If you’ve followed my work, you already know how central the CPR is to my analysis.

If you’re new to it, I strongly suggest reading this first:

👉 Central Pivot Range (CPR): The Market’s Guiding Compass

CPR acts as the heartbeat of the market. It represents the balance point between buyers and sellers — a fair value zone from the previous period. When the CPR is wide, it signals balance or consolidation. When it’s narrow, it hints at upcoming volatility or expansion.

I treat the CPR as my starting point for building a market framework. Everything else — highs, lows, supports, resistances — builds around this central structure. Think of it as the foundation upon which all other pivots are constructed.

Previous Period’s High and Low — The Market’s Memory

Once the CPR is plotted, the next step is marking the previous period’s high and low.

This “period” can mean anything depending on the timeframe you trade: a day, week, month, quarter, or even a year. The logic never changes.

The previous period’s high and low represent the boundaries of institutional activity — areas where large orders were filled and where market participants agreed on the extremes of value.

These levels are crucial because when price revisits them, it often tells us whether the current trend still has strength or if the market is beginning to reject higher or lower prices.

A breakout above a previous high may indicate fresh initiative buying, while a failure there could mean absorption and reversal. Similarly, a breakdown below a previous low might trigger new selling or a short-covering rally.

These aren’t random levels — they are psychological and structural boundaries that guide the next leg of movement.

Quarter Divisions of the Range — The Real Structure

Now comes the part most traders overlook.

Instead of drawing static horizontal lines and calling them support or resistance, I divide the distance between the previous high and low into four equal quarters. Each 25% portion of that range acts as a progressive level of expansion or contraction.

Imagine the total distance between the previous high and low as 100%.

Each quarter of that range represents how far price might travel before it starts to encounter natural resistance or support based on past volatility. This creates a structured grid — not based on prediction, but on proportion.

By dividing the previous range into four sections, you get a clear visual understanding of market rhythm. The first 25% move is usually exploratory, the middle section is where the battle happens, and the last portion often shows exhaustion or climax.

Range Expansion Levels — R1 to R4 and S1 to S4

Once the previous range is divided, we extend those divisions upward and downward from the previous high and low. This gives us the R (Resistance) and S (Support) levels.

If the previous high-to-low range is, say, 100 points:

- R1 will be 125% of that range (a 25 point extension above the previous period high)

- R2 will be 150% (a 50 point extension above the previous period high)

- R3 will be 175% (a 75 point extension above the previous period high)

- R4 will be 200% (a 100 point extension above the previous period high)

And in the opposite direction:

- S1 will be 125% below the previous low

- S2 will be 150%

- S3 will be 175%

- S4 will be 200%

Each extension represents a controlled measure of volatility expansion.

The logic here is simple: when markets move beyond their previous range, they often do so in multiples of that prior volatility. These pivot extensions help you visualize how far price can stretch before it becomes statistically overextended.

When price crosses R1, it’s no longer random movement — it’s controlled expansion. Beyond R3 or R4, the market is either in a powerful breakout or approaching exhaustion. Similarly, when price dips below S3 or S4, it often signals capitulation or a deep discount zone.

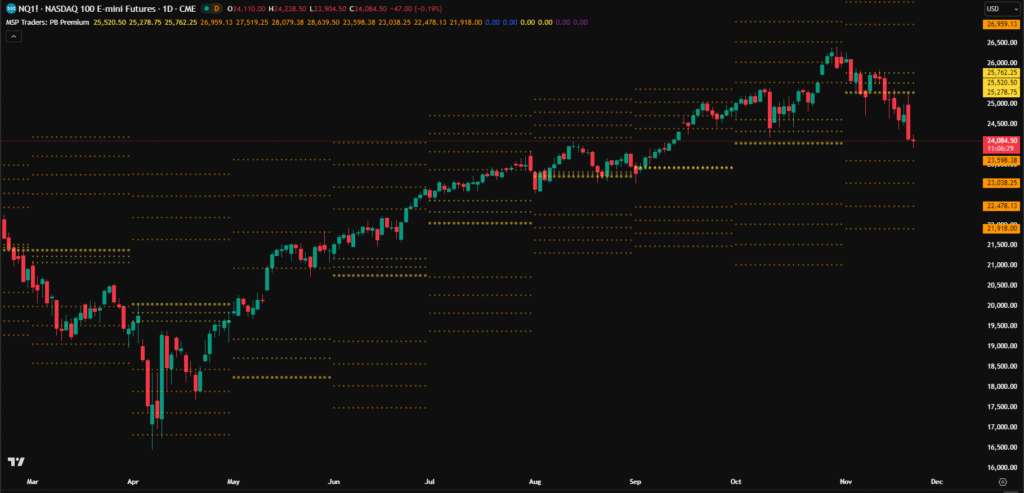

Example: NQ Futures

In the example of NQ Futures (refer to the image), the yellow dotted lines represent the CPR, the white lines mark the previous quarter’s high and low, and the orange lines show the four levels of resistance and support — R1 through R4 above and S1 through S4 below.

What you’ll notice is how rhythmically the market interacts with these levels.

It often pauses at R1, rejects near R3, and finds balance around the CPR. This is not a coincidence — it’s structure in motion. Once you start reading charts this way, every move starts to feel connected, not chaotic.

In Essence

These pivots create a market map.

CPR gives you the core balance, previous highs and lows give you boundaries, and the 25% divisions turn that map into measurable, tradeable structure.

Once plotted, you can instantly recognize when the market is:

- Expanding beyond its previous range

- Balancing between major boundaries

- Approaching exhaustion or reversal zones

This structure doesn’t predict the future — it clarifies the present.

And that clarity alone is what separates professionals from the rest.