Over the last few months, PureCycle Technologies (PCT) has been on a rollercoaster ride — soaring more than 200% in value. It’s one of those moves that make traders sit up and say, “This is what a powerful trend looks like.”

If you’ve read my post on Using CPR as a Powerful Trend Detector in Trading, you already know how I identify these kinds of trends. PCT has been a textbook example of that — strong directional bias, clean structure, and consistent follow-through.

But the real question now is — what’s happening at the current level?

1. A Sharp Drop After an Extended Rally

Recently, the stock has dropped more than 12% in just two trading days. After a 200% rally, that’s not just volatility — that’s the market catching its breath.

Sharp drops like these often appear scary to inexperienced traders, but to a trained eye, they reveal context. When something moves that far, that fast, it’s natural for price to pause, digest, and allow new players to enter.

2. Watching the Big Players’ Footprints

When I apply my framework of HTF Pivot Analysis – Following the Big Players, something interesting appears.

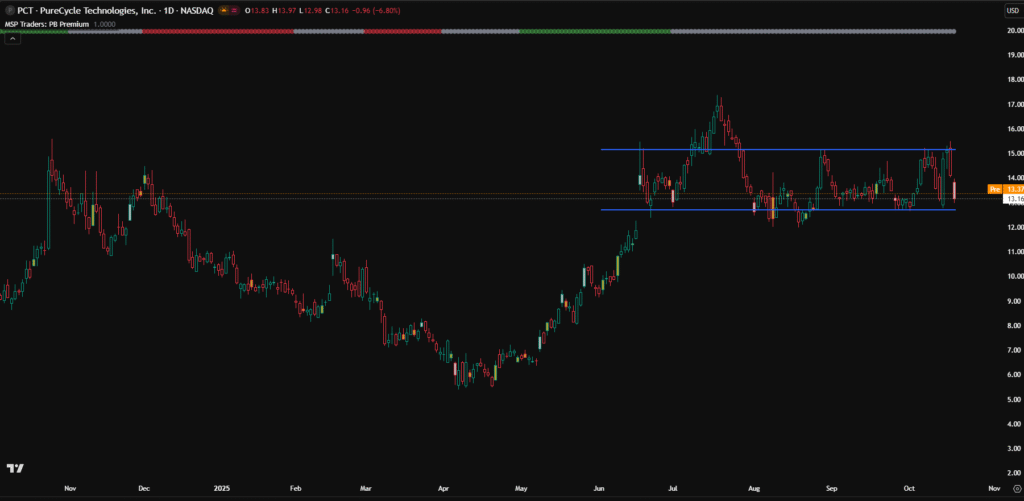

PCT’s price is currently hovering near the previous year’s high — a level where it already faced rejection once.

Now, why is that important?

Because this is where institutional traders — the “big players” — often make their next move. These levels are not just lines on a chart; they’re decision zones where liquidity gathers and market sentiment shifts.

If PCT manages to push and stay above that previous yearly high, the structure would clearly confirm a strong bullish continuation. But until that happens, it’s smart to treat this area as a battleground between buyers and sellers.

3. The Market’s Favorite Phase – Price Acceptance

Many traders expect a quick reversal after a strong move. But that’s not how the market really works.

After a big trend, the market doesn’t immediately collapse. Instead, it builds acceptance — a sideways movement where price starts finding agreement among participants.

If you’re unfamiliar with this concept, you’ll love my post on Price Acceptance.

That’s exactly what PCT seems to be doing right now. The price has been trading within a range for the last few months — a range that’s wide enough to trade but narrow enough to trap emotional traders.

4. Trading the Range – The Real Opportunity

Personally, I love this kind of structure.

Why? Because these sideways ranges are often 15% – 20% or more wide, creating excellent short-term opportunities. In this case, it is wide more than 18%.

Look at PCT’s recent behavior — it has been moving from one edge of the range to another within a single month. For a swing trader, that’s a golden opportunity to capture multiple high-probability trades without chasing breakouts.

These are the phases where patience pays. You wait for one side of the range to get tested, see the reaction, and then align your trades accordingly.

5. What Next for PCT?

Ranges don’t last forever.

They’re like pressure cookers — building up energy quietly before exploding in one direction.

Here’s how I see it:

- If the range breaks to the downside, the price could easily return to around $9, or even back to the level where the big rally began.

- If it breaks to the upside, there’s a clear path toward $19 — a level that’s absolutely achievable given how the stock has behaved before.

Either way, it’s a situation to keep on your radar — because both trend traders and range traders have something to gain here.

Final Thoughts

PCT is not crashing. It’s resting.

This phase is where smart traders plan, not panic.

A strong uptrend followed by consolidation is a healthy sign, not a warning bell. It shows that the market is digesting gains and preparing for its next leg.

So, watch those higher timeframe pivots, respect the yearly high, and stay ready for a breakout — whichever side it chooses.

Because when price acceptance ends, momentum begins.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Social Profiles:

Follow on X

Follow on Facebook