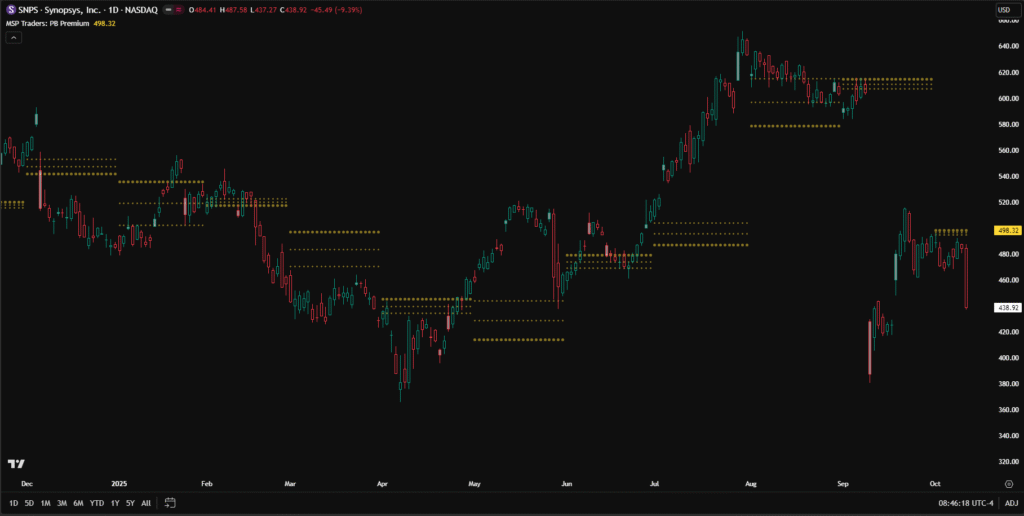

If you’ve read my previous post — How I Identify Strong Market Trends Using Pivot Points — you already know how pivots silently narrate the story of market bias, strength, and trend shifts. This time, instead of just theory, let’s take a real-world example — Synopsys Inc. (SNPS) — and walk through how I study month-by-month price behavior using Monthly CPR (yellow lines in the chart). We’ll decode 2025’s price movements one month at a time. You’ll see how CPR not only reflects trend bias but also gives early warnings before headlines catch up.

January to March 2025: A Consistent Bearish Bias

From the beginning of 2025, Synopsys was in a controlled decline. Each month — January, February, and March — showed the same pattern: price opened below the Monthly CPR, and closed below it as well. That consistent opening–closing alignment beneath CPR signaled bearish control. When you see this repeatedly, it’s not noise — it’s structure. It tells you that sellers are comfortably defending higher levels. This is how we define a bearish bias in pivot analysis — and it remains active until the opening and closing relationship flips.

April 2025: The First Sign of a Structural Change

In April, something subtle but important happened. For the first time in the year, price closed above the monthly CPR, even though it opened below it. That’s a key observation. When such an event occurs after months of continuous bearish alignment, it doesn’t necessarily mean “buy now” — but it means the structure is weakening. The market was telling us: sellers may be losing grip. Either a pause is coming or a change. At this stage, smart traders observe closely. We don’t predict — we prepare.

May 2025: Confirmation, But With Caution

In May, the chart confirmed that the April change wasn’t random. This time, the month opened above the Monthly CPR, confirming a shift to bullish bias. However, just because bias turns bullish doesn’t mean you jump in immediately. A true trend requires a base of support. The rule is simple: wait until the price takes support on the Monthly CPR before positioning on the long side. The bias may have flipped, but discipline is what separates preparation from premature action.

June 2025: The Retest and Strength Confirmation

Price opened below CPR but took support on monthly CPR — exactly what we look for after a trend change. This behavior — support on CPR after a bullish shift — confirms trend acceptance. It was the market saying: yes, I’m ready to move higher. Momentum traders would have noticed the strength building up here, and July would reward that patience beautifully.

July 2025: Momentum Unleashed

July was a strong month. With price continuing to hold above CPR and buyers defending every dip, the stock extended its upward move. This phase represents the reward zone of pivot trading — when your structure-based analysis pays off. But the real lesson isn’t just in the profit — it’s in the sequence: Bearish → Structural Warning (April) → Confirmation (May) → Validation (June) → Momentum (July). This is how clean, rule-based trend analysis unfolds.

August 2025: When the Market Ignores the Setup

Even though the bullish bias continued in August, something interesting happened — the price didn’t move much. It stayed mostly sideways, showing hesitation despite all technical conditions remaining bullish. And that’s where most beginners get frustrated — “Why isn’t the stock moving?” But here’s the truth: no concept works 100% of the time. Markets breathe. They consolidate, digest, and confuse before moving again. The key is to not get shaken when a few months don’t follow your expectation — pivots are about probability, not perfection.

September 2025: The Warning Before the News

September was the month that caught most retail traders off guard — but not pivot observers. Price opened below the Monthly CPR again — the same kind of structure change we saw earlier in April–May, but in reverse. This was the first red flag that the bullish phase might be losing strength. To add to it, September saw a huge gap down — and you can bet news headlines were full of random reasons: “earnings miss,” “valuation fears,” or “market rotation.” But the truth is, pivots warned you weeks before the media even noticed. When CPR alignment flips again after a trending move, the message is loud and clear — something has changed in the market’s internal balance.

October 2025: Bias Still Bearish

As of October, the bearish structure continues. The month opened below the Monthly CPR, and unless it closes above it, the downward bias stays active. In simple terms: until both opening and closing sync above the Monthly CPR, the trend remains in control of sellers. Traders must respect that alignment — not fight it.

Expected Outcome: What I’m Watching Next

Going forward, what I’ll watch is simple: if the next month opens above CPR, that’s the first hint of potential reversal. But confirmation only comes when it closes above it — not before. Until then, the dominant structure is bearish. This is where discipline meets patience — the two most underrated edges in trading.

Conclusion: Why Pivots Tell the Truth Before the News

The beauty of Monthly CPR is that it doesn’t predict — it reflects. When you learn to interpret it properly, it tells you what’s already happening beneath the surface — long before headlines catch up. In SNPS, we saw a clear bearish phase early 2025, a structural change signal in April–May, a valid uptrend from June–July, and an early warning of reversal in September. That’s the entire market cycle, captured without a single indicator apart from CPR.

Want to Learn More?

If you found this breakdown helpful and want to understand the deeper logic behind CPR, trend bias, and pivot-based structures, read my earlier post: How I Identify Strong Market Trends Using Pivot Points. It will help you connect the dots between structure, psychology, and execution — the same foundation I use in my professional trading.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Follow on X – https://x.com/MSP_Traders