Tootsie Roll Industries (TR) has shown a huge drop, more than 17% in just three sessions, and that too in a stock which was trending smoothly for months. Let’s see what’s actually happening at the current level and why this move is so surprising.

📉 A Sudden and Unexpected Fall

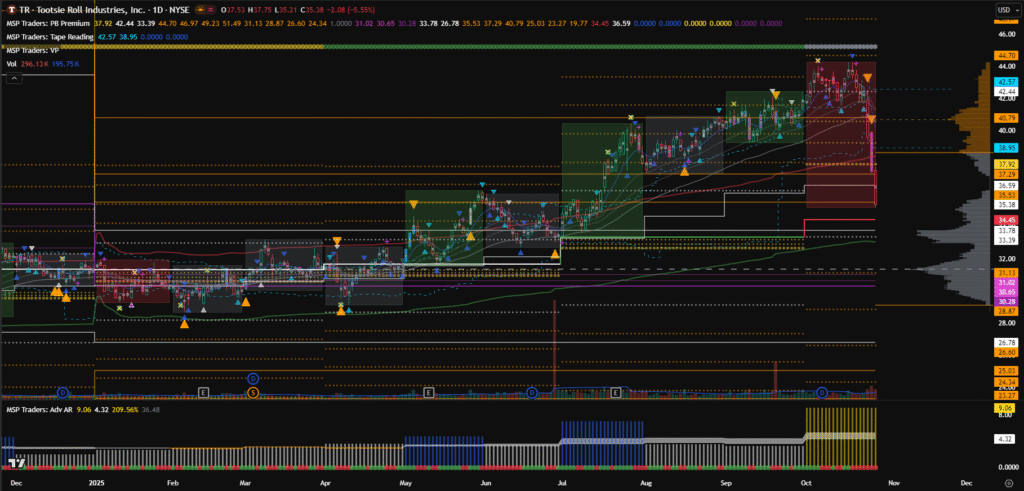

The price was trending beautifully, holding above PYH ($33.78) for several months with a consistent upper-moving bias. There was no visible weakness, no exhaustion sign, and no clear warning that something like this was coming. That’s what makes this fall so unexpected. The structure had been showing strength, and then within just three sessions, the stock corrected sharply, leaving traders shocked and confused. When a trending stock behaves this way, it’s often a sign that volatility has entered the market rather than a complete change in direction.

📊 Volatility Shoots Up

The current monthly range has expanded to $9.06, which is more than 200% higher than its average monthly range. That’s an extreme expansion in volatility. Whenever such a move happens, we must treat the price action carefully. A big monthly range means the market is going through a strong repricing phase. It doesn’t always mean the trend is over — sometimes it’s just the market shaking off weak hands before continuing in the main direction.

Right now, 33.39 to 33.78 stands as a very strong support zone because it aligns with both PYH and PQL. As long as this area holds, the structure stays intact. However, if price breaks below this zone, the next important area is the YCPR zone, roughly between 30.28 and 31.00. This is where the next reaction might appear. If you’re not familiar with these jargons, I’ve explained them clearly in this post.

🔍 What the Structure Says

If you have read using CPR as a powerful trend detector in trading, you already know how CPR behaves as a strong trend filter. According to that framework, there is still no confirmed bearish signal yet. The recent drop might look scary, but price has not accepted below the key pivots, which means this could just be a volatility flush rather than a trend reversal.

From my observation, and as I discussed in on following the big players, big players often defend these types of levels. That’s why I personally expect the price to take support and possibly bounce from around the 33.78 zone. It’s a level that represents both technical and psychological importance, where larger market participants usually step in to absorb selling pressure.

🧭 Possible Market Scenario Ahead

Even though the market has dropped sharply, I don’t see a confirmed bearish phase starting immediately. This kind of move can easily turn into a wide trading range, where the market oscillates for a few months before choosing a new direction. We have to let the structure build first. If 33.78 holds, a rebound toward the mid-range zone could appear. If that level breaks, price might extend lower toward the YCPR area before stabilizing again.

For now, patience is more important than prediction. I’ll keep watching how price reacts around these key zones. If you want to follow this entire scenario step by step, connect with me on social media. I’ll keep posting updates as it unfolds. And if you have any questions or want to understand this structure in more detail, feel free to reach out — I’ll be happy to discuss it.

Cheers !!

Arup MSP

Creator of Pivot Mastery (The Practical Way to Understand Market Context)

Social Profiles:

Follow on X

Follow on Facebook